Money Worries | Evidence-based, digital mental health

Support individuals to better understand the link between financial worries and mental health

The Money Worries programme was designed by experts to help organisations to support customers to manage the relationship between financial difficulties and poor mental wellbeing during a time of financial uncertainty. .

In a recent study, it was determined that 94% of UK employees are suffering from money worries.

How the SilverCloud® by Amwell® platform can elevate the support your business can offer

Individuals with mental health problems are 3X more likely to experience financial difficulties compared to those without.

Providing mental health services to those who are struggling with fear and anxiety due to job loss, overspending, debt, or potential redundancy, can help to alleviate and better manage their symptoms.

Together, we can deliver tools to help your customers and clients to better understand and manage their money worries and improve their relationship between their financial health and mental health.

Testimonials

"Space from Money Worries is developed specifically to try and break the link between financial difficulties such as debt and poor mental health such as depression, stress and anxiety. It combines research on what turns financial difficulties into poor mental health (for example worry, shame, hopelessness), and uses skills from psychological therapies such as Cognitive Behavioural Therapy (CBT) to help tackle these."

Dr. Thomas Richardson,

Associate Professor of Clinical Psychology & CBT at University of Southampton

Money Worries Programme Goals

The Money Worries Programme tackles the practical and emotional challenges of financial difficulties. Participants learn to manage unhelpful thoughts around finances, how to stop avoiding money problems, and are empowered to feel more confident facing their financial fears.

It has been designed by experts to help participants better manage and understand their financial worries by:

-

Developing an understanding of the relationship between their finances and their mental health

-

Learning to normalise their problems and reduce their shame and self-criticism

-

Being encouraged to face their fears and become more assertive and in control when it comes to managing their finances

-

Recognising real vs. hypothetical worries, and how to challenge negative thoughts and prevent impulse spending

-

Developing techniques to reduce the risk of impulse spending

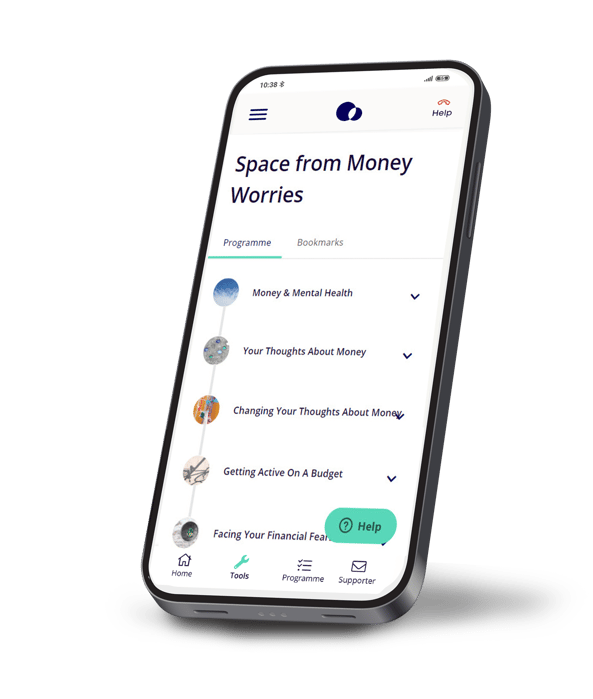

Modules

- Money and Mental Health

- Your Thoughts About Money

- Changing Your Thoughts About Money

- Getting Active on a Budget

- Facing Your Financial Fears

- Managing Worry About Money

- Acceptance and Hope About Money Difficulties

- Getting Control Over Impulse Spending

- Staying financially healthy

Interactive tools

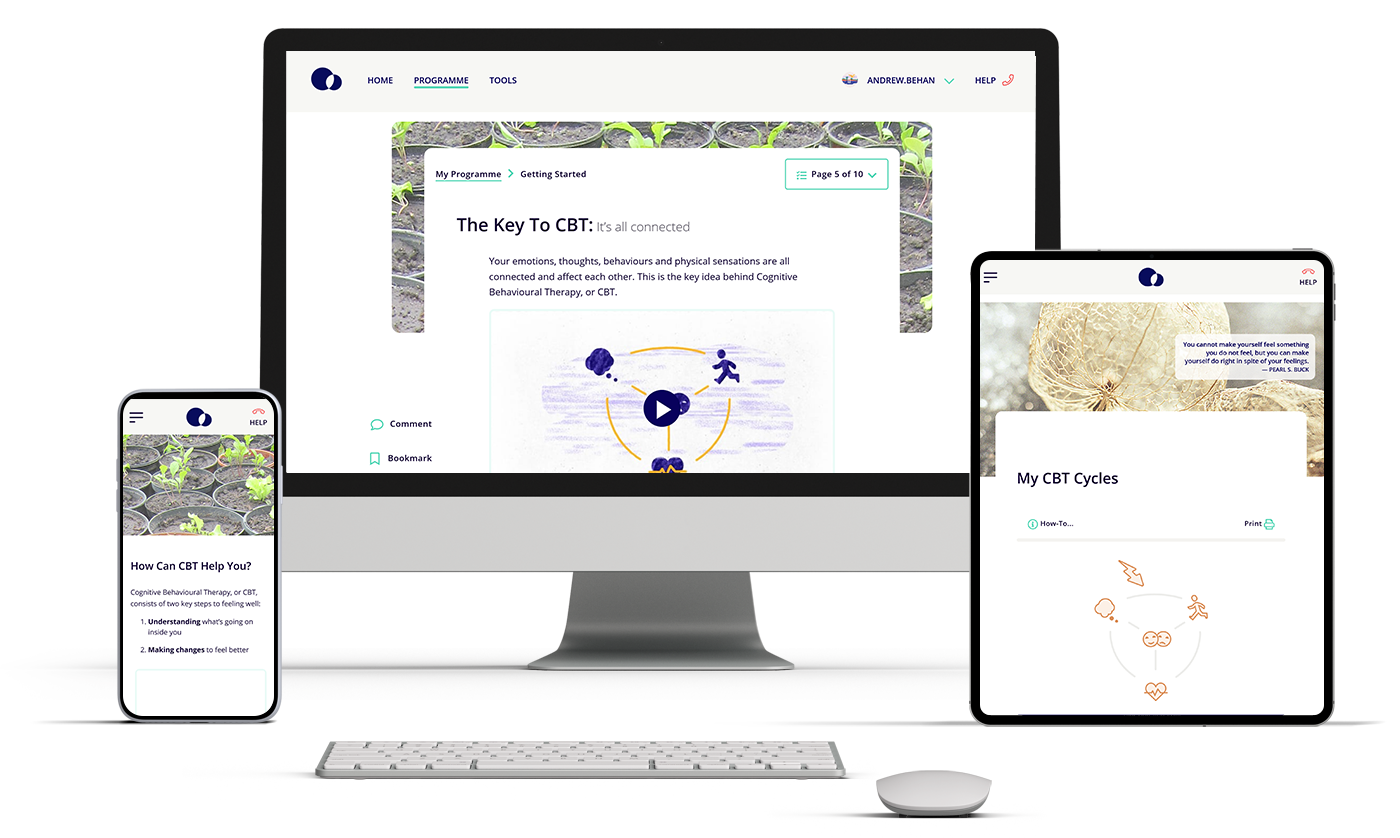

We provide both coach-supported and self-guided programmes. Coached programmes provide extra guidance and one on one encouragement to those who need additional motivation. Our self-guided option allows participants to work through programmes at their own pace.

-

Mindfulness Exercises

-

Relaxation Techniques

-

My Values

-

Making it Harder to Impulse Spend

-

Steps I Need to Take

-

Progressive Muscle Relaxation

Cognitive Behavioural Therapy

With CBT, participants will better understand their thoughts, feelings, and behaviours and learn how to make positive changes - proven to reduce symptoms and better manage their mental health and wellbeing. Participants walk away with the tools to better manage their mental health now and in the future.

Learn more: understand the evidence behind helping individuals in dealing with anxiety and depression when it comes to financial difficulties in a conversation with Dr. Thomas Richardson.